Hard money lending –a fractionalized market

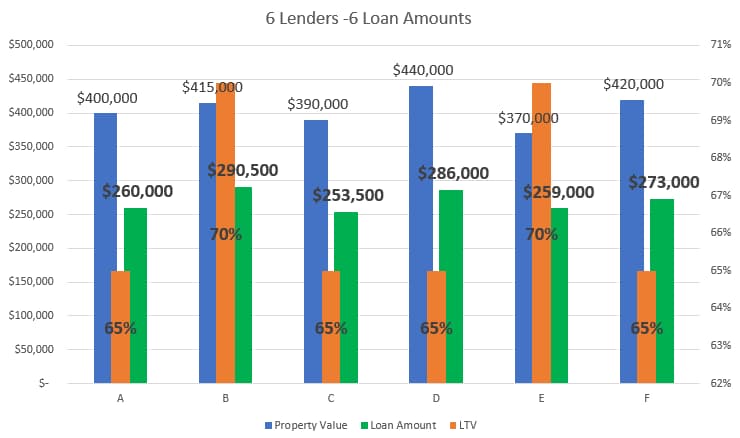

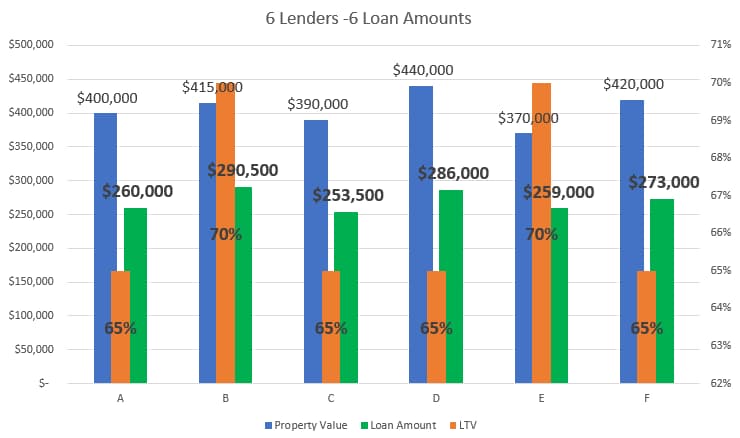

To demonstrate how hard money lenders differ from each other, look at the 6 lenders, A, B, C, D, E, and F, in the graph and notice that each one offers a different maximum loan amount. Although Lender D estimated the property to be $440,000, Lender B offers the highest loan amount because his LTV is 70%. The differences become even more pronounced when you discover that each lender offers different interest rates and fees and has different requirements for documents.

Inexperienced lenders can cause you to have sleepless nights and lose money even when they mean well. Check the lenders on Google, Yelp, LinkedIn, BBB, and other social media before you email any confidential information. If a lender requests a deposit, double-check the lender's history and ask for references. To be safe, check out the company's experience and reputation and the loan officer before you sign any documents or verbally agree to loan arrangements.

Trust Deed investment

Hard money is also known as a Trust Deed investment. The lender will record a Deed of Trust against the property, and the Borrower will have to pay the investor back before he can refinance or sell the property. If the Borrower can't make the payment, he will have to sell the property, or the investors can take the property in foreclosure and sell it to recover their investment.

Bridge Loans

Almost all hard money loans are for short periods. Lenders arrange loans for 6-36 months, with most loans for 12-18 months. Hard money Loans are often called BRIDGE LOANS because of their temporary function, which is either to give borrowers time to sell the property or to get it refinanced. (Few lenders can arrange hard money loans for 5, 7, or even 10 years until 2022 borrowers didn't mind paying high interest for the bridge loans, hoping that they will be able to refinance the loans with a long-term bank loan with a very low rate. When bank rates started to climb in 2022 and 2023, borrowers realized that they might not be able to get a lower bank rate, and savvy borrowers are now seeking longer terms, such as BRIDGE Loans, for 24—36 months.

Who arranges hard money loans?

Thousands of hard money lenders are looking to invest their own or investor money in loans secured by real estate equity. This investment is popular because of the high rate the investor gets and the security of the funds. In this article, we give you a list of the types of hard money lenders but keep in mind that they all fit under several designation types.

For example, Lender A can be a Direct Lender, a Wholesale Lender, a Retail Lender, a Gorilla, and a Vacant Land Lender.

For example, Lender B can be a Direct Lender, a No-Appraisal Lender, a Wholesale Lender, a Blanket Loan Lender, and a Fast-Closer Lender.