The art of pitching your loan request to lenders

The Lendersa platform will distribute your loan request to many qualified lenders simultaneously, and instead of wasting hours explaining your loan to each investor, having a good summary will save you lots of time.

Hard money loans are different from one to the next, and you will get faster results if you explain the loan purpose clearly and with enough detail for investors to understand it comprehensively.

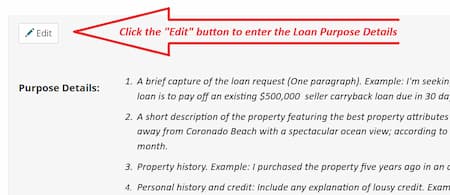

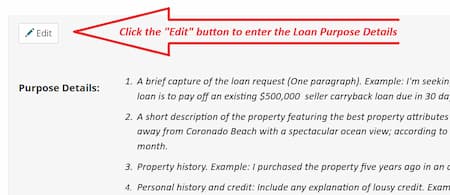

Edit the Loan Purpose Details

The loan purpose is your pitch to investors, and it should include the following elements:

A brief statement of the loan request (one paragraph). Example: I'm seeking a bridge loan for $650,000 on my non-owner residential property. The purpose of the loan is to pay off an existing $500,000 seller carryback loan due in 30 days. I'll use the cash out of about 130k for my business.

A short description of the property featuring the best property attributes and it's location. Example: The property is a single-family residence located five minutes away from Coronado Beach with a spectacular ocean view; according to Zillow, the property value is $1,245,000. The property is currently rented for $3,700 a month.

Property history. Example: I purchased the property five years ago in an auction and spent $55,000 on a new roof and renovated kitchen.

Personal history and credit. Also include any explanation of lousy credit. Example: I've been a real estate agent for 15 years and have experience renovating and selling homes in the San Diego area. Four years ago, I filed for Chapter 7 BK to delay foreclosure on another property where I had a hostile lender; the BK was discharged two years ago, the property was sold, and the lender received all his principal and interest in full.

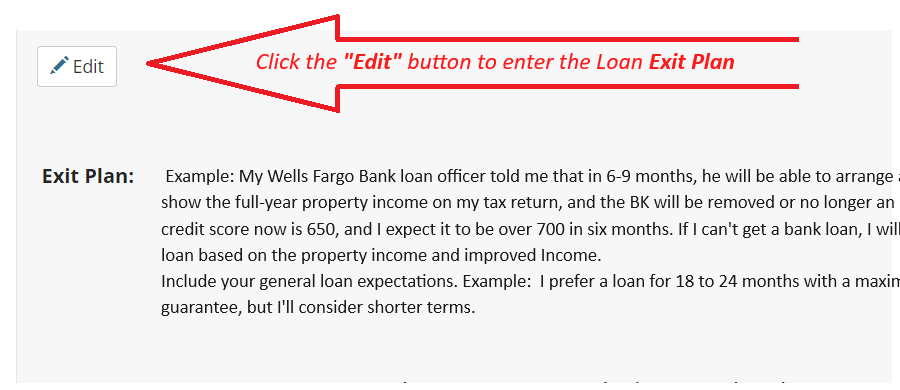

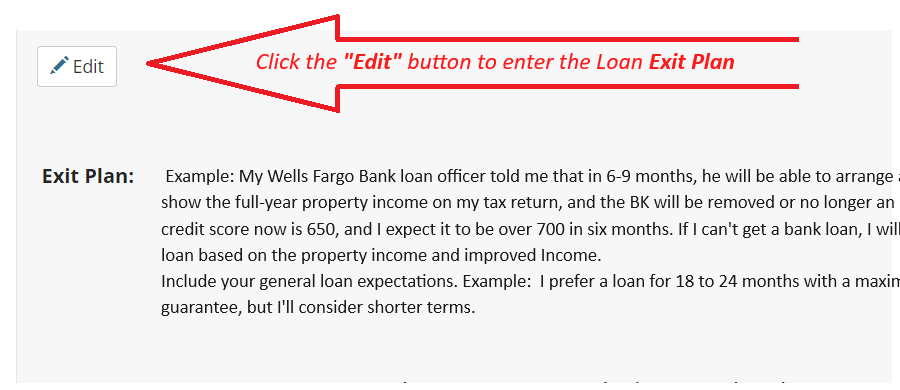

Edit the Exit Plan

The Exit Plan: You must explain, in a very coherent manner, how you will repay the loan. Most hard money lenders do not want to foreclose; unless you explain how you pay them back, they will not consider the loan. Be careful of lenders who don't care about your exit plan because they could give you a hard time at payoff. More importantly, you must have a solid exit plan before getting a new hard money loan. Don't look for a bridge loan with a balloon payment until you have an exact plan for paying it off. It is ok to include one or more exit options in your plan.

Example:

My Wells Fargo Bank loan officer told me that in 6-9 months, he will be able to arrange a bank loan because I will show the full-year property income on my tax return, and the BK will be removed or no longer an issue for the bank. My credit score now is 650, and I expect it to be over 700 in six months. If I can't get a bank loan, I will still be able to get a DSCR loan based on the property income and improved Income.

Include your general loan expectations. Example:

I prefer a loan for 18 to 24 months with a maximum of a 6-month payment guarantee, but I'll consider shorter terms.

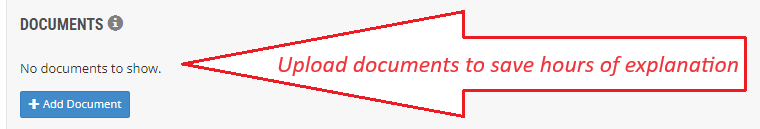

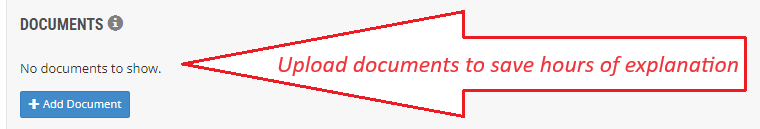

Uploading documents will save you hours of explanation

Upload documents to expedite your approval process. Your loan request will be delivered to several lenders, but you only have to upload the documents once. Documents are important to understand the property and your financial situation.

- Upload pictures of the property, including pictures of the inside. If you have made any improvements to the property, take photos and upload them.

- Upload plans, permits, and certificates of occupancy for all recent changes or upcoming changes.

- If you have appraisal reports, recent or old ones, upload them. Although old appraisals will have incorrect market values, it will give the lenders other vital information about the property, such as rooms, square footage, yard, etc.

- If you have access to the title report, upload it.

- If you have an application, even an old one, upload it

- Upload the credit report only if it is recent.

- After receiving preliminary approval, proposal, or LOI, you may upload tax returns and bank statements.

- Upload an explanation of property market value. (If you notice the websites showing a lower market value than what you know, include an explanation that you can upload as a new document with what the actual market value is. Most discrepancies happened when there were recent additions to the property's square footage, room count, bathroom count, etc. It can take a long time before changes to the properties get picked up by search engines; therefore, you need to explain it in a separate document and upload copies of the plans, diagrams, certificates of occupancy, etc. Every lender will ask for those documents; it is best to upload them in advance.

- Upload an explanation of and credit problem

Why add links?

Adding links will expedite your lender approval process.

You should add a link to the property on Google maps. https://www.google.com/maps

Look up your property on Zillow and add a link to the property's Zillow profile. https://www.zillow.com/

Do the same for Realtor.com https://www.realtor.com/

And Redfin.com https://www.redfin.com/

For commercial properties, search Loopnet and link to your property.