Ready To Apply For Hard Money Loans Today?

If you cannot get a bank loan on real estate, whether for new construction or for investment, you could still get Hard Money loans in Los Angeles , CA to enhance your business or fulfill your financial obligation.

Many people do not understand what hard money is and how it works.

Even borrowers who have experience with Hard Money Loans in Los Angeles County, in the past are still unaware of the secrets and the misconceptions surrounding it.

This guide clarifies Hard Money and will show you the secrets to obtain the loans that you could not get until now. You will also learn how to convert your existing loans to better loan programs. (Better rate, longer terms, more money, etc.)

Hard Money Definition: For this discussion, we define a hard money loan as any loan secured by real estate originated by a non-bank entity.

There is a grey line between hard money loans and some portfolio loans arranged by portfolio lenders, sometimes referred to as Subprime lenders or Alt-A lenders.

The table below shows the three subtypes of Hard Money Loans in Los Angeles, CA.

|

Hard Money Loans

(Subtypes)

|

Underwriting priorities |

Source of funds |

Rate |

Duration |

Funding time |

Max LTV |

| H1 |

Hard- hard money loans |

Mainly equity |

Private Investors |

8%-16% |

6-24 Mts |

3-15 days |

60-65 |

| H2 |

Soft, hard money loans |

Equity and other factors |

Private Investors |

6%-12% |

12-60 Mts |

7-30 days |

60-75 |

| H3 |

Portfolio Non-QM loans Subprime loans Alt-A loans

|

Credit equity and other factors |

Private institutions/money |

5%-10% |

10-40 Years |

20-60 days |

75-90 |

Some will argue that only H1 is considered hard money, or only H1 and H2 are hard money loans but not H3.

30 years ago, it was only H1. However, with the advent of computers and the internet, lenders became more sophisticated.

Although the equity in real estate is still a dominant factor, other factors were added to underwriting to increase the availability and competitive edge of non-bank lenders.

This table shows how H1, H2, and H3 fits with LTV and FICO

| FICO |

80% or more |

75% LTV |

70% LTV |

65% LTV |

60% LTV |

55% LTV |

50% LTV or less |

| 500 |

|

H2 |

H2 |

H1,H2 |

H1,H2 |

H1,H2 |

H1,H2 |

| 550 |

|

H2 |

H2 |

H1,H2 |

H1,H2 |

H1,H2 |

H1,H2 |

| 600 |

H2 |

H2 |

H2 |

H1,H2 |

H1,H2 |

H1,H2 |

H1,H2 |

| 640 |

H2 |

H2 |

H2 |

H1,H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

| 680 |

H2 |

H2,H3 |

H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

| 700+ |

H3 |

H2,H3 |

H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

H1,H2,H3 |

From the borrower's point of view, the names of subtypes designation do not matter.

What is essential are only the following issues:

1. How much money can I get?

2. What will it cost me? (Rate, fees, etc.)

3. How fast can I get it?

4. What do I need to have/show to close the loan?

Ready To Apply For Hard Money Loans In Los Angeles County?

How difficult it is to get Hard money loan?

In general, when the LTV is under 60% all 3 types of hard money loans are available. Portfolio loans have the best rate & terms but takes longer to fund. Portfolio lenders take into consideration credit and income can lend up 80% or 90% LTV.

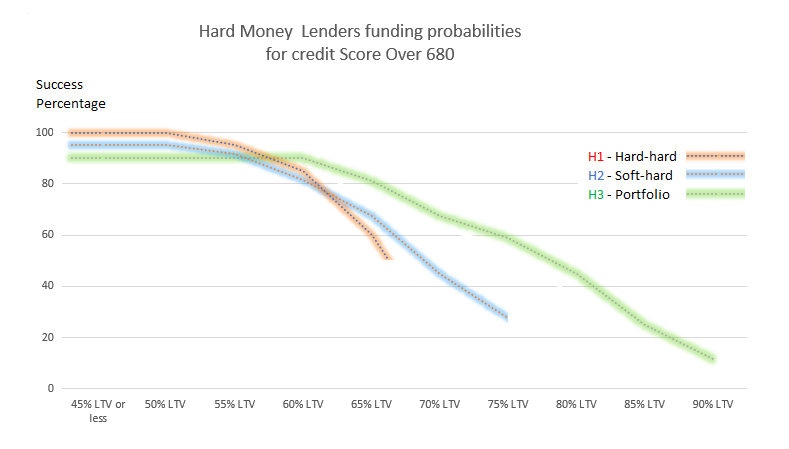

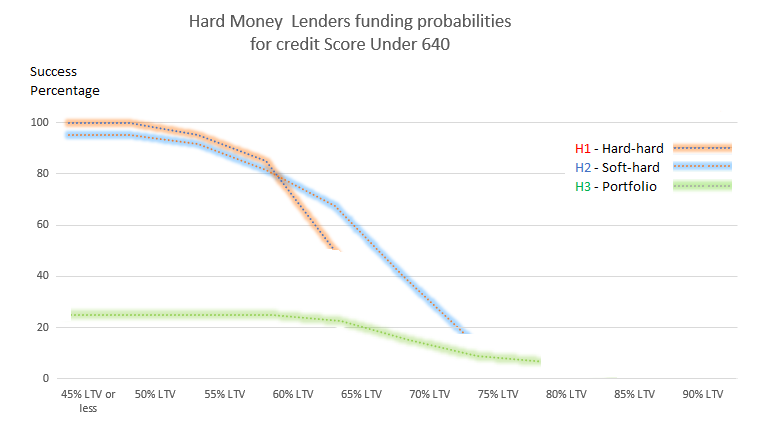

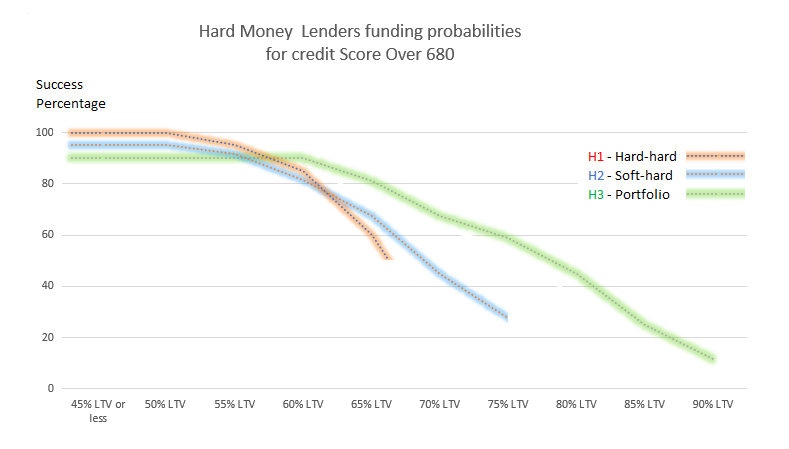

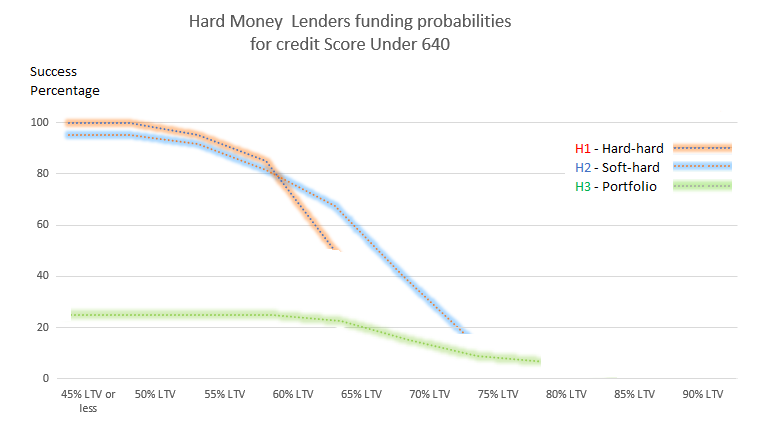

The graphs below show the probabilities of success among the 3 hard money groups. Notice that with FICO above 680 the chances to get loans with higher LTV are increased. Income verification and other factors are also important for any loan and especially for loans with LTV above 60%

How Hard Money Loans Are Different?

Underwriting

Conventional loans, FHA, USDA, and VA loans are each have their unique underwriting guideline. If you wish to obtain a Conventional loan in Los Angeles, you will contact any of the thousands of local lenders, and you will have the same underwriting requirement no matter which Lender you reach.

Unlike Conventional Bank Loans, which have uniform underwriting standards among all Conventional lenders in the country, Hard Money lending, on the other hand, does not have any underwriting rules, and its underwriting standards are varied from one Lender to another.

Among the thousands of hard money lenders in Los Angeles, none of the programs and qualifications are identical. The loan programs can be similar yet different among all hard money lenders.

For that reason, it is imperative for you, the borrower, to search and compare as many hard money lenders as you can before you give up or before you decide on a loan.

Although hard money lenders have considerable leeway to decide on the loan programs, they must abide by Federal and local government regulations.

Compare Underwriting of Loan programs

|

Underwriting Standards |

Authority |

| Hard Money |

NO |

Each Lender decides its own* Program |

| Conventional |

YES |

FNMA-FREDDIE MAC |

| FHA |

YES |

HUD |

| VA |

YES |

Department of Veteran |

| USDA |

YES |

Department of Agriculture |

* In addition to the Authority who set up the underwriting guidelines, all lenders are subject to general Federal and State regulation and their respective disclosures laws.

Compare Hard money Rate& terms Max LTV and speed of funding to other loan programs

| Type of loan |

Max LTV |

Rate |

Points |

Speed of funding |

| Hard Money |

50%-90% |

5-16 |

0%- 10% |

3-45 days |

| Conventional |

97% |

2.5- 4.0 |

0-2 |

30-60 days |

| FHA |

96.5% |

2.5- 4.0 |

0-2 |

30-60 days |

| VA |

100% |

2.5- 4.0 |

0-2 |

30-60 days |

| USDA |

100% |

2.5- 4.0 |

0-2 |

30-60 days |

Finding hard money lenders

Finding hard money lenders

Since hard money lenders in Los Angeles, CA can decide their own guidelines, each Hard Money loan program is different than all other Hard Money programs.

In theory, if you could search and compare all existing hard money programs, your chances to get a loan that fits your need will increase exponentially.

Practically (without using Lendersa), it is impossible to investigate more than a handful of Lenders, which makes the process of finding hard money lender a hit and miss proposition.

It gets even worse when time is of the essence to get the money.

When borrowers are under pressure to get the money, they will accept the first loan offer.

Should they have more time or use Lendersa, undoubtedly, they could find a much better loan.

Lendersa developed the first and only technology that compares thousands of Hard Money Loan programs with your single request.

Ready To Apply For Hard Money Loans In Los Angeles County?

The Seven Hard Money Loan Myths BUSTED!!!

There are seven misconceptions about hard money loans.

Most hard money lenders in Los Angeles, CA know about it yet would not disclose it to potential borrowers, not because of any evil intention to deceive and not because of any attempt to mislead the borrowers but only because it is not too easy to explain.

Understanding these seven misconceptions can save time money and perhaps allow you to get the loan that would be otherwise unobtainable:

1. Hard money loans are based only on having equity in real estate.

2. Hard money lenders are going to steal your property

3. Direct hard money lenders are better than hard money brokers

4. Hard money is only for borrowers with bad credit

5. Hard money loans are only last resort

6. Hard money loans are only for short terms

7. Only for non-owner

1. Hard money loans are based solely on having equity in real estate.

1. Hard money loans are based solely on having equity in real estate.

Although equity is still the backbone of almost all hard money lending today, the concept of having property equity as the sole factor in approving a hard money loan is no longer correct.

Here are the main factors lenders look at when deciding on whether to approve a hard money loan:

- Equity

- Credit

- Income and expense

- Location

- Loan amount

- Loan position

- Borrower experience

- Type of property

- Property Condition

- Exit plan

- Borrowers financial strength

- Loan duration

- Interest Rate and fees

- Prepay penalties and extensions

- Speed of funding

- Other considerations

Hard money lenders in Los Angeles, CA always take into consideration several of the factors before approving any loan.

There is no such thing as only equity.

To stay competitive, lenders must take into consideration other factors, or they will lose the loan.

2. Hard money lenders are going to steal your property

2. Hard money lenders are going to steal your property

Most hard money lenders are only interested in getting interest payments on their investments.

They do not want to acquire the property in foreclosure and do not wish to engage in collection efforts.

Most investors leave loan servicing with the brokers or with servicing companies.

3. Direct hard money lenders are better than hard money brokers

3. Direct hard money lenders are better than hard money brokers

The benefit of working with direct lenders is that they decide on each loan in-house, which can sometimes cut down on time to get the approval back to the borrower.

The main disadvantage of direct lenders is that they only lend certain types of hard money loans, and if they decline your loan request, you will have to start all over again looking for a new lender.

Knowledgeable Brokers know what each Lender can do, and they can save you lots of time by finding the right investor.

Good brokers will negotiate the loan with wholesale lenders, and many times, you will pay the same fees that you would pay a direct lender.

Ready To Apply For Hard Money Loans In Los Angeles County?

4. Hard money is only for borrowers with bad credit

4. Hard money is only for borrowers with bad credit

Borrowers with perfect credit resort for hard money lenders when they need to fund a project fast.

Waiting for a bank approval may put the borrower at risk of losing a lucrative business deal.

Borrowers with excellent credit would pay a higher fee and interest rate temporarily to accomplish their business objectives.

Lendersa surveyed hundreds of hard money lenders in Los Angeles County to determine the Max LTV they will lend to borrowers based on the borrower credit. The table below shows the results:

| FICO |

75% or more |

70% LTV |

65% LTV |

60% LTV |

55% LTV |

50% LTV |

| 500 |

1% |

3% |

65% |

72% |

72% |

76% |

| 550 |

2% |

4% |

72% |

76% |

77% |

78% |

| 600 |

3% |

6% |

76% |

78% |

80% |

80% |

| 650 |

5% |

10% |

78% |

80% |

85% |

90% |

| 700 |

7% |

13% |

85% |

87% |

90% |

100% |

| 750+ |

8% |

15% |

90% |

92% |

95% |

100% |

Example A.

| FICO |

75% or more |

70% LTV |

65% LTV |

60% LTV |

55% LTV |

50% LTV |

| 750+ |

8% |

15% |

90% |

92% |

95% |

100% |

The 750+ Fico credit score line shows that only 8% of the lenders will lend 75% LTV to borrowers with a credit score of 750+. It also shows that 100% (every Lender!) will lend to borrowers who have 750+ Fico and only 50% LTV. (This Table does not consider any other factors).

Example B.

| FICO |

75% or more |

70% LTV |

65% LTV |

60% LTV |

55% LTV |

50% LTV |

| 550 |

2% |

4% |

72% |

76% |

77% |

78% |

The 550 Fico credit score line shows that only 2% of the lenders will lend 75% or more LTV to borrowers with a credit score of 550. It also shows that 78% of the lenders will lend to borrowers who have 550 Fico but only 50% LTV.

5. Hard money loans are only last resort

5. Hard money loans are only last resort

Uneducated borrowers fear hard money because they do not understand it.

The fact is that without showing enough income tax returns, all that a borrower can do is borrow Hard Money.

The H3 type of hard money can go to high LTV with good credit and alternative income verification instead of taxes.

Of course, there is no harm done to look for a conventional type loan before checking into the hard money.

At Lendersa, the borrowers do need to guess which program they could get since all they care about is not the name of the program but:

1. How much money can I get?

2. What will it cost me? (Rate, fees, etc.)

3. How fast can I get it?

4. What do I need to have/show to close the loan?

All that is needed is to complete a loan request, and Lendersa will calculate the best possible loan program.

Sometimes the borrower's objective is to get a loan in a few days.

Even though he may qualify with tax returns to very low-interest rates, the borrower cannot wait, and his “best” loan will be the fastest loan and not the loan with the lowest rates.

6. Hard money loans are only for short terms

6. Hard money loans are only for short terms

The H1 loans are at a 4%-10% higher rate than conventional loans, and to keep it for a long duration does not make economic sense.

The H1 lenders typically offer 12-24 month duration. H2 loan duration can be between 1 to 30 years, and H3 loans are 10 to 40 years.

7. Only for non-owner

7. Only for non-owner

Conclusion for equity and credit relationship:

It is easy to see that borrowers who wish to borrow 65% LTV or less will have no trouble finding hard money lenders, but borrowers who want to borrow above 65% LTV will have to search harder before they can find a lender.

Ready To Apply For Hard Money Loans In Los Angeles County?

Notice how the availability of loan programs reduced drastically above 65% LTV.

Notice how the availability of loan programs reduced drastically above 65% LTV.

To avoid unpleasant surprises from a low appraised value or other issues with the current Lender, you should always consider a contingency loan plan in place,

1. Discuss with Lender what will happen if the appraised value is not what was expected and know your options in advance.

2. If you must get the loan no matter what, then have 2-4 backup lenders that have reviewed and approved your loan on standby just in case the Lender you are working with fails to arrange the loan for any reason.

If you have in front of you 100 loan programs from 100 different hard money lenders in Los Angeles, CA and if you also have the loan requirements of each Lender right in front of your face, it will take you hours to sort it out and decide which Lender's program to take.

And if you are a genius that found the best one, there is a very slim chance that the Lender you selected will be able to fund the loan you request!

Why is it?

There are 2 main reasons:

1. The facts matching the qualification requirement of the lenders are somewhat subjective and could be different than what you consider facts.

E.g., you believe the property value is $500,000, and the Lender believes the value is only $450,000.

Even if you have an appraisal report that shows a value of $500,000, the Lender may appraise the property only at $450,000. Since an appraisal is nothing but an opinion, it will be challenging to overcome the discrepancy in values.

E.g., you believe that the property is in a great location of the city, but the Lender some issues with the location.

E.g., you believe that your credit score is 700 based on credit karma check, but the Lender checked three bureaus and has a different mid score of only 660.

2. Private lenders (and also banks) are not able to fulfill the loan programs they advertise.

-

The Lender ran out of money to fund new loans.Many hard money brokers rely on private investors, and when the investors don't have money or no longer want to invest, the broker needs to find new private investors, a process that can take several days or weeks and will defeat your funding time goal.

Lenders go through cycles in their eagerness to do loans. It depends a lot on the pool of private investors the Lender is representing. In normal times the private investors hate to have money sitting in their bank account, earning nothing instead of "the money is working" - earning 6-10%.

Lenders become HOT when their private investors are pushing them to find a home for their money. Lenders become inactive when they cannot find investors.

-

The loan program rate and terms and qualifications are not up-to-date. Rate, terms, and programs can change overnight, and the Lender does not have the time to update the program. Some new government laws prevent the Lender from funding certain loan programs.

-

Some lenders exaggerate their rate sheets or their qualification requirement in order to entice borrowers to apply for a loan. After the borrower invests lots of time on the application, the Lender will try to sell him a different, more expensive, and less favorable loan.

This practice called bait and switch and his highly unethical and for government loans also illegal.

So there you have it, all the misconceptions, and myths and secrets busted and exposed, so you now can take with you all the information about hard money loans in Los Angeles County, how they work, and know how to obtain them for any type of real estate transaction, whether for investment, portfolio or new construction. Apply today!

Ready To Apply For Hard Money Loans In Los Angeles County?

Finding hard money lenders

Finding hard money lenders 1. Hard money loans are based solely on having equity in real estate.

1. Hard money loans are based solely on having equity in real estate. Notice how the availability of loan programs reduced drastically above 65% LTV.

Notice how the availability of loan programs reduced drastically above 65% LTV.