.

Hard Money Lenders: Quick Loans at Your Fingertips

Are you in urgent need of a

loan? Are traditional lenders turning you down? Hard money loans may be the

solution you're looking for. In this blog, we'll explore the world of hard

money lending and its significance in today's financial market. We'll dive into

the details about how hard money loans work and their role in financing.

Additionally, we'll identify the top hard money lenders for instant loans,

including why Kiavi stands out among other lenders. We will also discuss the

borrower's perspective and what makes a good lender. For real estate flippers,

we'll explain why hard money loans are essential and how to choose the best

lender for your needs. Lastly, we'll cover how hard money loans can help

prevent foreclosure, funding renovation projects, and why an accurate appraisal

is crucial for securing a hard money loan. So sit back and let us guide you

through everything you need to know about hard money loans.

Understanding

Hard Money Loans and Their Significance

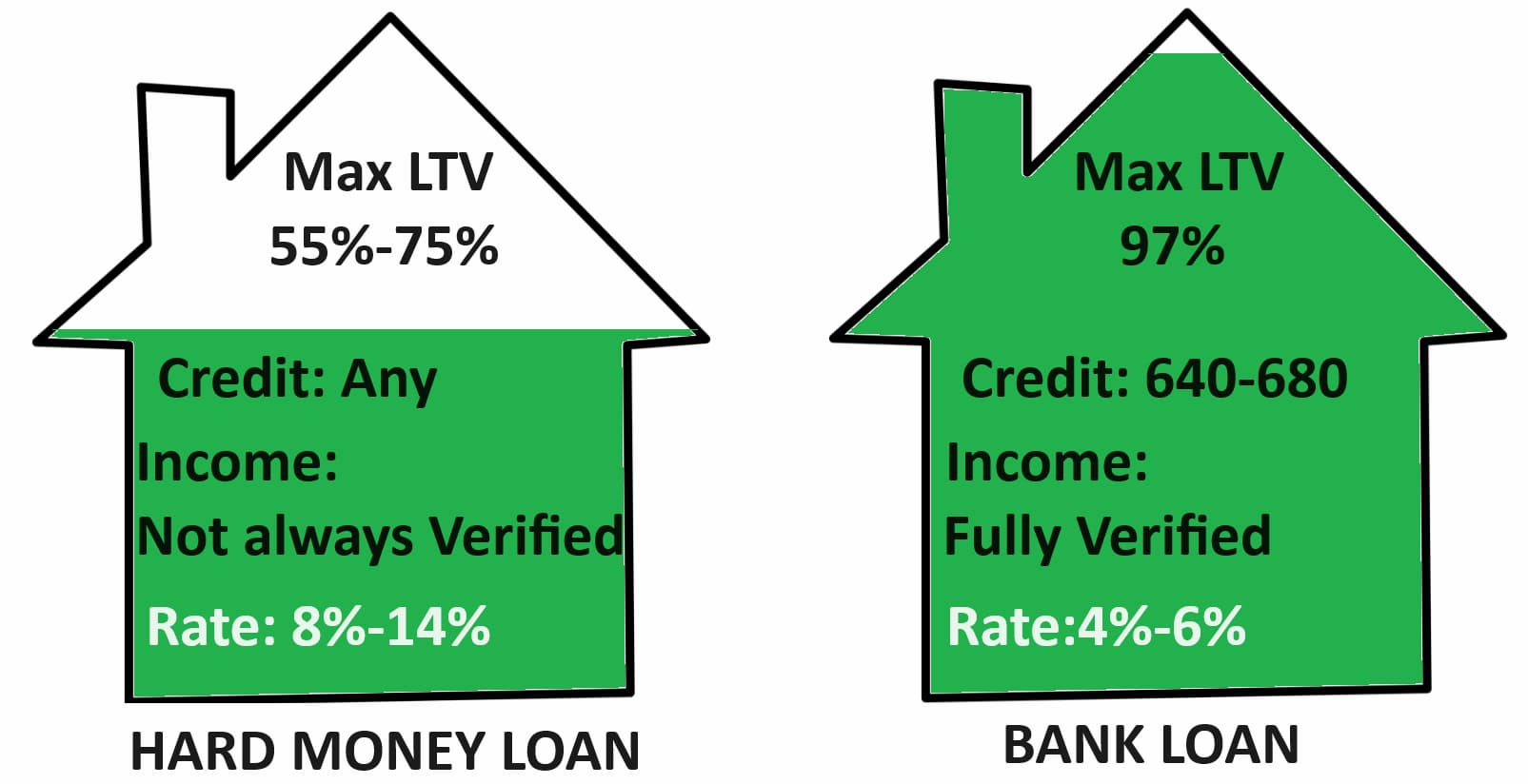

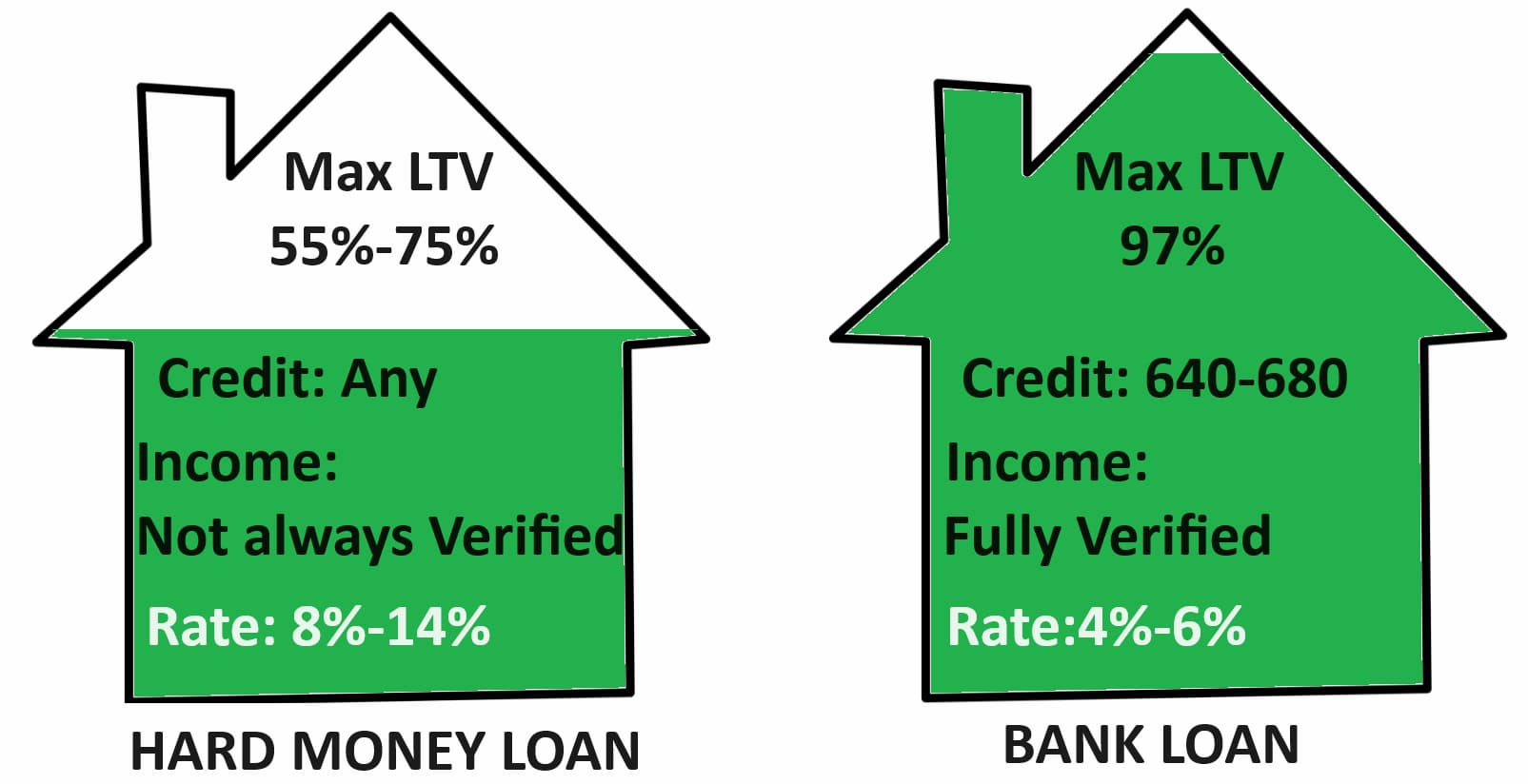

What exactly are hard money loans and why do they play a crucial role in the real estate industry? How do these loans differ from traditional bank loans? Let's delve into the significance of hard money loans and explore how they benefit borrowers. Additionally, it's essential to understand the risk factors associated with these types of loans. Lastly, we'll discuss how hard money loans can be a valuable tool for real estate investors. By understanding the ins and outs of hard money loans, borrowers and investors can make informed decisions to meet their financial goals.

The

Basic Concept of Hard Money Loans

What exactly are hard money loans? Well, they are short-term loans that are secured by real estate. Unlike traditional bank loans, these loans are funded by private investors or companies. Typically, hard money loans come with higher interest rates and shorter repayment terms. They can be used for various real estate purposes, such as purchasing fix-and-flip properties. One important thing to note is that the value of the property serves as collateral for these loans. So, if you're considering a hard money loan, keep in mind that it's a short-term option with some unique factors to consider.

The

Role of Hard Money Lenders in Financing

Have you ever wondered how hard money lenders play a crucial role in financing real estate projects? Unlike traditional bank loans, hard money lenders provide quick access to funding without focusing solely on the borrower's credit score. Instead, they evaluate loan applications based on the value of the property and its potential profitability. This allows them to offer flexible loan amounts and repayment terms, catering to the specific needs of borrowers. Whether it's for purchasing fix-and-flip properties or funding construction projects, hard money lenders bridge the gap for borrowers who may not qualify for conventional loans. Their expertise in real estate allows them to assess risks and provide valuable financing options.

Identifying

the Top Hard Money Lenders for Instant Loans

When choosing a hard money lender for instant loans, borrowers should consider several criteria. Kiavi is a standout among hard money lenders due to its competitive rates and fast approval process. RCN Capital is known for its quick financing solutions and extensive experience in the industry. Lima One offers a competitive advantage with its flexible loan options and excellent customer service. By exploring the unique features and benefits of each top hard money lender, borrowers can make an informed decision. With options like ltv, type of loan, and down payment, these lenders provide solutions for various real estate projects. Choose the best hard money lender based on your specific needs and requirements.

Why

Kiavi Stands Out Among Hard Money Lenders

With its competitive interest rates, Kiavi sets itself apart from other hard money lenders. Borrowers appreciate the efficient and streamlined approval process offered by Kiavi. What makes Kiavi truly stand out is its commitment to providing personalized loan solutions tailored to the unique needs of each borrower. Kiavi prides itself on excellent customer service and support, building a strong reputation in the industry. Transparency and honesty are at the forefront of Kiavi's values, distinguishing it from other hard money lenders. When it comes to finding the best hard money lender, Kiavi is a top choice for borrowers seeking instant financing options.

RCN

Capital and Its Edge in Quick Financing

Looking for a reliable and fast funding solution? Look no further than RCN Capital. With its extensive experience in the industry, RCN Capital is known for its quick and efficient financing solutions. Whether you're a real estate investor or a homebuyer, RCN Capital offers a wide range of loan programs to meet your specific needs. Their underwriting process is thorough and efficient, ensuring quick approval for your loan. What sets RCN Capital apart is their commitment to providing the unique advantages of choosing them for instant loans. With RCN Capital, you can experience the ease and convenience of quick financing for your real estate ventures.

The

Competitive Advantage of Lima One

Looking for flexible loan

options for instant financing? Lima One might just have the competitive

advantage you need. With Lima One, borrowers can enjoy competitive rates and

favorable loan terms, giving them the financial flexibility they desire. But

it's not just about the rates and terms – Lima One also stands out for its

exceptional customer support throughout the loan process, ensuring a smooth

experience from start to finish. And when it comes to speed, Lima One shines

with quick turnaround times and an efficient underwriting process that sets it

apart from competitors. Explore the benefits of choosing Lima One for your

instant hard money loans.

The

Borrower's Perspective: What Makes a Good Lender?

Key considerations for borrowers when selecting a hard money lender include reputation, credibility, loan terms, and flexibility. Working with a reputable lender maximizes the benefits for borrowers. Tips for evaluating lenders and making informed borrowing decisions are essential.

Key

Considerations for Borrowers Seeking Instant Loans

When considering instant loans,

borrowers should carefully assess the experience and track record of potential

lenders. Clear communication and transparency are key, as borrowers need to

fully understand loan terms, interest rates, and repayment options. It's

important to work with a lender who can provide quick approvals and funding,

especially for time-sensitive projects. Conducting due diligence and selecting

the right hard money lender is crucial. Maximizing the benefits of instant

loans involves considering factors such as LTV, down payment, credit history,

and repair value. By finding a reputable lender that meets their specific

needs, borrowers can secure the financing they require for their projects.

How

Can Borrowers Maximize the Benefits of Instant Loans?

To maximize the benefits of instant loans, borrowers should have a well-defined plan and strategy in place. They can leverage these loans for time-sensitive real estate opportunities and enhance their investment portfolio. However, it's important to carefully consider the potential risks and rewards associated with using instant loans for real estate projects. Effective management and minimizing pitfalls are crucial for successful utilization of instant loans.

Real

Estate Flippers and Their Relationship with Hard Money Lenders

Real estate flippers often turn to hard money lenders for various reasons. One of the key benefits of hard money loans for flippers is the flexibility they offer. Unlike traditional lenders, hard money lenders are more willing to lend based on the after-repair value (ARV) of the property rather than the borrower's credit score. This makes hard money loans a common choice for experienced flippers who may not meet the strict guidelines of traditional lenders. Additionally, hard money lenders can provide quicker approvals and funding, allowing flippers to seize time-sensitive opportunities. The relationship between real estate flippers and hard money lenders is crucial in enabling successful flips and maximizing returns on investment.

The

Importance of Hard Money Loans for Flippers

Why are hard money loans so crucial for real estate flippers? These loans provide quick financing, allowing flippers to seize time-sensitive opportunities in the market. Unlike traditional loans, hard money loans have advantages such as flexible criteria, making them suitable for both experienced and new flippers. Moreover, hard money loans help flippers overcome cash flow challenges by providing funds upfront for purchase price, repairs, and renovations. With their less strict guidelines and shorter repayment terms, hard money loans cater specifically to the needs of property flippers. In the competitive world of flipping, hard money financing acts as a valuable resource for flippers looking to maximize their investment potential.

How

Flippers Can Choose the Best Hard Money Lender

How can real estate flippers select the ideal hard money lender? What factors should they consider when making this crucial decision? Flippers need to weigh multiple factors, such as loan terms, interest rates, and underwriting guidelines. Comparing the loan-to-value ratio and considering upfront costs are also essential steps. Flippers should examine a lender's experience in financing flipping projects and consider their credit history. Additionally, they should explore different types of loans available, including bridge loans and lines of credit. It's crucial for flippers to find a hard money lender who understands their unique needs and can provide the necessary funds efficiently and quickly.

Dealing

with Foreclosure: How Hard Money Lenders Can Help

Dealing with Foreclosure: How Hard Money Lenders Can Help

Struggling homeowners facing foreclosure often wonder if hard money loans can prevent this financial disaster. Hard money lenders offer options that can provide a temporary solution to avoid foreclosure. They evaluate properties in foreclosure cases, considering factors such as the loan-to-value (LTV) ratio, repair value, and the borrower's credit history. While hard money loans may come with high interest rates and short repayment terms, they can be a lifeline for homeowners in distress. However, it's essential to be aware of the limitations and risks associated with using hard money loans to avoid foreclosure. By understanding their role, homeowners can make informed decisions about their financial future.

The

Role of Hard Money Loans in Preventing Foreclosure

How do hard money loans offer an alternative to traditional mortgage lenders? Can hard money loans be used to pay off existing mortgages in default? What advantages do hard money loans have in preventing foreclosure? Can homeowners with bad credit still qualify for hard money loans to avoid foreclosure? Are there any specific loan terms or requirements for borrowers in foreclosure situations? Hard money loans provide homeowners facing foreclosure with a viable alternative to traditional mortgage lenders. These loans can be used to pay off existing mortgages in default, giving homeowners the opportunity to avoid foreclosure. One advantage of hard money loans is that they are available to borrowers with bad credit. They also offer more flexible loan terms and requirements compared to traditional lenders. By tapping into the equity of their homes, homeowners can secure a hard money loan and prevent foreclosure.

Foreclosure

Cases: When Should You Consider Hard Money Loans?

Considering hard money loans in foreclosure cases can be a last resort for homeowners facing financial difficulties. These loans provide temporary solutions and can help homeowners negotiate with their existing lenders. However, it's important to carefully assess the circumstances and explore other options before opting for hard money loans.

Renovations

and Hard Money Loans: A Perfect Match?

Why are hard money loans a great option for financing renovation projects? Hard money loans simplify the financing process and can be used for both minor and major renovations. They offer advantages over traditional renovation loans, and hard money lenders may have specific requirements for approving renovation projects.

The

Benefits of Using Hard Money Loans for Renovation Projects

If you're considering a renovation project, hard money loans offer several benefits. Firstly, these loans provide flexibility, allowing you to customize your renovation plans without strict guidelines. Additionally, hard money loans can cover the costs of both materials and labor, ensuring that you have the necessary funds for your project. Another advantage is the quick approval process for renovations, which can save you time and expedite your project. Even if you have a lower credit score, you may still qualify for a hard money loan for renovations. Finally, there are specific loan terms and conditions available for financing different types of renovations.

Tips

for Getting a Hard Money Loan for Renovation

When securing a hard money loan for renovations, flippers can take several steps to increase their chances of approval. Firstly, they should research and find hard money lenders that specialize in renovation projects, ensuring that they understand the specific requirements and lending criteria. It is also important for flippers to gather and prepare all necessary documentation, such as project plans, cost estimates, and property details. Hard money lenders typically consider factors such as the borrower's credit history, loan-to-value ratio (LTV), and the after-repair value (ARV) of the property. Additionally, flippers should inquire about competitive rates and loan terms for renovation projects. By following these tips, flippers can navigate the process of obtaining a hard money loan for their renovation ventures.

Appraisal

in the Context of Hard Money Loans

Appraisal plays a crucial role in the approval process of hard money loans. While traditional lenders heavily rely on appraisals to determine property value, hard money lenders often have more flexible options. They may use alternative methods, such as their own assessment of the property's repair value or the after-repair value (ARV). These methods allow hard money lenders to quickly evaluate the investment potential of the property. Different types of properties may have specific appraisal requirements, but hard money lenders are typically more concerned with the property's potential value and the borrower's ability to repay the loan. Even flippers with limited experience can still qualify for hard money loans without a detailed appraisal, as the focus is more on the property's potential and profitability.

Why

is an Accurate Appraisal Important for a Hard Money Loan?

An accurate appraisal is crucial for hard money loans. It determines the property's value, protects borrowers from overpaying, and helps lenders assess loan-to-value ratios. By ensuring sufficient collateral value, an accurate appraisal reduces the risk of default.

Conclusion

To wrap up, hard money lenders play a crucial role in providing quick financing solutions for various needs in the real estate industry. Whether you're a borrower in need of instant funds or a real estate flipper looking for reliable financing options, it's essential to choose the right hard money lender that aligns with your goals and requirements. Consider factors such as reputation, competitive rates, and customer service when selecting the best lender for your needs. Additionally, leverage the benefits of hard money loans for renovations and understand the importance of accurate appraisals in securing a loan. With the right lender by your side, you can navigate foreclosure cases and ensure a successful outcome.

USA.Gov Grants and Loans

Comptrollers Handbook- Commercial Real Estate Lending

Wikitia - Lendersa

Bigger Pockets Forcelosure