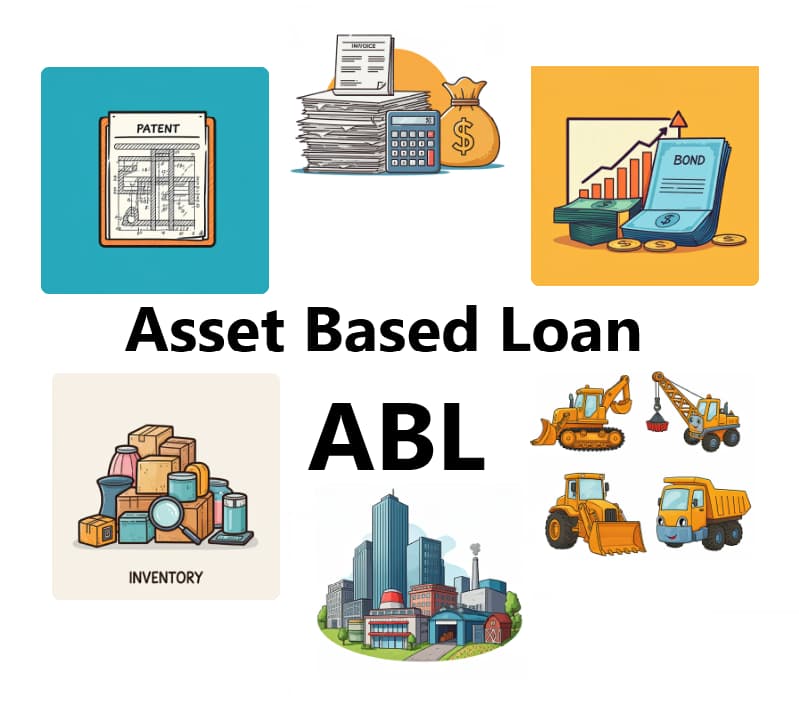

Do you know about the 6 types of ABLs? Asset-based loans are structured around the value of a borrower's assets. For businesses, these assets often include inventory, equipment, and, importantly, accounts receivable. By leveraging these assets, companies can obtain financing that might not be available through traditional lending avenues.

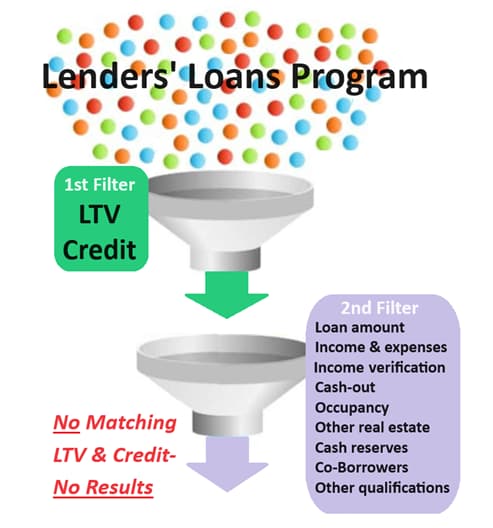

Traditional business financing usually looks at how much money a company makes (its cash flow) to decide if it can get a loan. This method works well for many businesses. However, some companies might have assets (like property, accounts receivable, equipment, marketable securities, or intellectual properties and trademarks) that they can use to get a loan, even if their cash flow isn't strong. This is called asset-based Lending (ABL).

With ABL, you can use various assets as collateral to get the money you need. If your business has valuable assets, ABL can give you a good amount of financing with fewer restrictions, allowing you more freedom in future decisions compa